Debt Management

Updated: November 22, 20241. Introduction

- 1.1. Purpose

- To fulfill its mission, East Carolina University will initiate strategic capital investments for additional academic, student life, medical, athletic, and other plant facilities using an appropriate mix of funding sources including State bonds and appropriations, University bonds, internal reserves, and private giving.

- The purpose of this debt policy is to ensure the appropriate mix of funding sources are utilized and to provide guidance on the strategic use of debt as a funding source. Debt is a valuable source of capital project financing, and its use should be limited to projects that relate to the mission and strategic objectives of the University. The amount of debt incurred affects the financial health of the University and its credit rating. Debt provides a limited source of funding for capital projects and, together with other limited resources, should be used and allocated appropriately and strategically.

- This policy provides a discipline and framework that management will use to evaluate the appropriate use of debt in capital financing plans.

- 1.1.1. Legislation

- Debt policies will conform with North Carolina General Assembly legislation ” Chapter 116D, Higher Education Bonds, Article 1, General Provisions.”

- 1.2. Objectives of the Debt Policy

- The objectives stated below provide the framework by which decisions will be made regarding the use and management of debt. The debt policy and objectives are subject to re-evaluation and change over time.

- 1.2.1. This Debt Policy is set forth to:

- 1.2.1.1. Outline a process for identifying and prioritizing capital projects considered eligible for debt financing and assuring that debt-financed projects have a feasible plan of repayment. Projects that relate to the University’s core mission and that have associated revenues will generally be given higher priority for debt financing.

- 1.2.1.2. Define the quantitative tests that will be used to evaluate the University’s overall financial health and present and future debt capacity.

- 1.2.1.3. Define project specific quantitative tests, as appropriate, that will be used to determine the financial feasibility of an individual project.

- 1.2.1.4. Manage the University’s debt to maintain an acceptable credit rating. The University, consistent with the capital objectives, will limit its overall debt to a level that will maintain an acceptable credit rating with bond rating agencies. Maintaining an acceptable credit rating will permit the University to continue to issue debt and finance capital projects at favorable interest rates, although the attainment or maintenance of a specific rating is not an objective of this policy.

- 1.2.1.5. Ensure the University remains in compliance with all of its post-issuance obligations and requirements.

- 1.2.1.6. Establish guidelines to limit the risk of the University’s debt portfolio. The University will manage debt on a portfolio basis, rather than on a transactional or project specific basis, and will use an appropriate mix of fixed and variable rate debt to achieve the lowest cost of capital while limiting exposure to market interest rate shifts. Several types of debt structures and instruments will be considered, monitored, and managed within the framework established in this policy and according to internal management procedures. Debt instruments covered by this policy include not only bonds, but obligations of the university, such as special obligations, lease purchases, installment purchases, commercial paper, limited obligations, notes, etc.

- 1.2.1.7. Assign responsibilities for the implementation and management of the University’s Debt Policy.

- 1.2.1. This Debt Policy is set forth to:

2. Process for Identifying and Prioritizing Capital Projects Requiring Debt

- The State of North Carolina adheres to the limits on debt issuance provided in its adopted debt affordability policy and the University must compete with all other state agencies for capital projects bonding authority. Therefore, it is essential that the University appropriately prioritize capital projects requiring debt.

- Management will allocate the use of debt financing within the University to include prioritization of debt resources among all uses, including academic and student life projects, plant and equipment financing, and projects with University-wide impact.

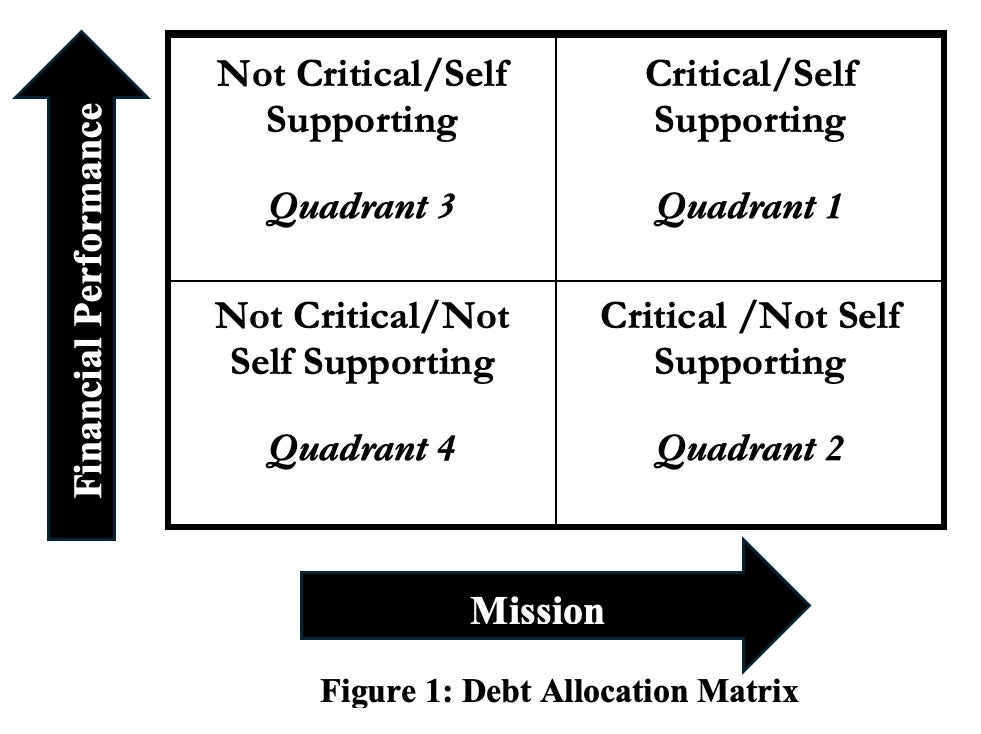

- The debt allocation matrix below depicts an approach to prioritizing capital projects requiring debt.

- 2.1. Explanation of debt allocation matrix

- 2.1.1. Quadrant 1: Project is critical to the University’s core missions of research, service or instruction and does have its own funding source(s) (i.e., non-general fund supported).

- 2.1.2. Quadrant 2: Project is critical to the University’s core missions of research, service or instruction but does not have its own funding source(s) (i.e., will require-general fund support).

- 2.1.3. Quadrant 3: Project is not critical to the University’s core missions of research, service or instruction but does have its own funding source(s) (i.e., non-general fund supported, energy conservation projects that provide annual savings sufficient to service the applicable debt and all related monitoring costs).

- 2.1.4. Quadrant 4: Project is not critical to the University’s core missions of research, service or instruction and does not have its own funding source(s) (i.e., will require general fund support).

- Note that approval of projects in Quadrants 3 and 4 will reduce the University’s ability to issue debt for the mission critical projects identified in Quadrants 1 and 2.

- 2.2. Guidelines for Prioritizing Capital Projects Requiring Debt

- Management will use the following guidelines when prioritizing capital projects and making decisions about financing options and use of debt:

- 2.2.1. Only projects related to the core missions of the University, directly or indirectly, will be eligible for debt financing.

- 2.2.2. State funding and philanthropy are expected to remain major sources of financing for the University’s capital projects. In assessing the possible use of debt, all other financing and revenue sources will also be considered. State appropriations and bonds, philanthropy, project-generating revenues, research facilities and administration cost reimbursement, expendable reserves, and other sources are expected to finance a portion of the cost of a project. Debt is to be used conservatively and strategically.

- 2.2.3. The University will consider other funding opportunities (e.g., joint ventures, real estate development, etc.) when appropriate and advantageous to the University. Opportunities and financing sources will be evaluated within the context of the Debt Policy.

- 2.2.4. Federal research projects will receive priority consideration for debt financing due to partial reimbursement of operating expenses (including the interest component of applicable debt service) of research facilities.

- 2.2.5. Every project considered for financing must have a defined, supportable plan of costs (construction and incremental operating) approved by management. Projects that have related revenue streams or can create budgetary savings will receive priority consideration. However, projects may not receive a higher priority simply because they are self- supporting. For example, projects that mitigate life safety issues may be given preference over self-supporting projects.

3. Quantitative Tests – Debt Ratios

- When evaluating its current financial health and any proposed plan of finance, the University considers both its debt affordability and its debt capacity. Debt affordability focuses on the University’s cash flows and measures the University’s ability to service its debt through its operating budget and identified revenue streams. Debt capacity, on the other hand, focuses on the relationship between the University’s net assets and its total outstanding debt.

- Debt capacity and affordability are impacted by several factors, including the University’s enrollment trends, reserve levels, operating performance, ability to generate additional revenues to support debt service, competing capital improvement or programmatic needs, and general market conditions. Because of the number of potential variables, the University’s debt capacity cannot be calculated based on any single ratio or even a small handful of ratios.

- The University has identified three key financial ratios that it will use to assess its ability to absorb additional debt based on its current and projected financial condition. The University has established for each ratio a floor or ceiling target with the expectation that the University will operate within the parameters of those ratios most of the time. To the extent possible, the policy ratios established from time to time in this debt policy should align with the ratios used in the report the University submits each year as part of the UNC Debt Capacity Study. The policy ratios have been established to help preserve the University’s financial health and operating flexibility and to ensure the University is able to access the market to address capital needs or to take advantage of potential refinancing opportunities. Attaining or maintaining a specific credit rating is not an objective of this debt policy.

- 3.1. Debt to Obligated Resources (Available Funds) *

- This ratio measures the aggregate outstanding debt as compared to its obligated resources—the funds legally available to service its debt. Obligated resources are available funds adjusted for GASB 68 and GASB 75.

- 3.2. Debt Service to Operating Expenses (Debt Burden Percentage) : This ratio measures the University’s debt service burden as a percentage of total university expenses. The target for this ratio is intended to maintain the University’s long-term operating flexibility to finance existing requirements and new initiatives. 3.3. Annual Debt Service Coverage*

- This ratio measures the University’s ability to cover debt service requirements from adjusted net operating income. This calculation is a three-year average of income compared to actual debt services on capital debt. The target established is intended to ensure that operating revenues are sufficient to meet debt service requirements and that debt service does not consume too large a portion of income.

- Monitored as part of the debt capacity study for The University of North Carolina delivered each year under Article 5 of Chapter 116D of the North Carolina General Statutes (the “UNC Debt Capacity Study”).

** Considered relevant indicators of Leverage and Debt Affordability by Moody’s Investors Service (Global Higher Education Rating Methodology, August 2021).

- 3.4. Outside stated policy ratio

- In an instance where the University falls outside a stated policy ratio, the Vice Chancellor for Administration & Finance will review each ratio in connection with the delivery of the University’s audited financials and will provide a report to the Board detailing:

- 3.4.1. the calculation of each ratio for that fiscal year and

- 3.4.2. an explanation for any ratio that falls outside the University’s stated policy ratio, along with

- 3.4.2.1. a) any applicable recommendations, strategies, and an expected timeframe for aligning such ratio with the University’s stated policy or

- 3.4.2.2. (b) the rationale for any recommended changes to any such stated policy ratio going forward (including any revisions necessitated by changes in accounting standards or rating agency methodologies).

- The University will also utilize additional leverage ratios and key determinants that are emphasized by the University’s bond rating agencies, such as Moody’s and Standard & Poor’s. The ratios will be calculated and reported annually, when new debt is issued, and revised periodically to reflect any changes in accounting standards. Ratios are derived from the financial statements and are based on current GAAP requirements, including the GASB 34/35 reporting format and are consistent with ratios used in the higher education industry to permit benchmarking. Ratios should also be calculated excluding the effects of GASB 68 for pensions and GASB 75 for other post-employment benefits. Furthermore, as GASB routinely implements changes to GAAP accounting rules, and any changes made by the rating agencies to ratio methodology will be incorporated accordingly.

4. Project Specific Quantitative Tests

- Consideration of the performance ratios will determine the ability and/or advisability of issuing additional debt from a University-wide perspective. Determination of the prioritization of individual projects to be allocated a portion of available debt capacity is a separate, internal decision that must be made before a project is initiated.

- Many factors will influence this internal decision process. Primarily, how is the project prioritized regarding mission criticality as described by the debt allocation matrix (four quadrant model) above. Although debt will be structured to meet the University’s comprehensive long-term objectives, each project being financed will be required to provide a sound business plan, including the source of repayment for the debt and appropriate and realistic repayment terms. Among other things, the repayment terms will require that the loan term is no greater than the expected useful life of the asset financed. Additionally, every project considered for debt financing must have a management approved plan of project costs, including incremental operating expenses and revenues. Incremental revenues include revenue increases directly associated with the project (e.g., usage fees) that can only be realized if the project is undertaken. Similarly, incremental expenses include any increase in expected operating costs associated with the project. Revenues and cost savings should be estimated conservatively, especially for high-risk projects.

5. General Debt Management Guidelines

- 5.1. Methods of Sale

- The University will use the method of sale that will achieve the lowest cost of capital considering the complexity of the transaction. This can be achieved by using either a competitive or negotiated sale method of sale of publicly sold bond offerings, or a negotiated direct placement with a bank or other lender. For transactions using new or non-traditional pledges of University revenues, or those involving greater complexity, a negotiated method of sale will be considered, and legislative approval requested, on an individual transaction basis. Bonds may also be sold through a private or limited placement, but only if it is determined that a public offering through either a competitive or negotiated sale is not in the best interests of the university.

- 5.2. Selection of Financial Advisors, Underwriters, Lenders, and Bond Counsel

- Unless otherwise directed by the UNC System Office, University will use a request for proposal process to select Financial Advisors, Underwriters, Lenders, and Bond Counsel, as required and as applicable. Firms providing financial advisory and bond counsel services are selected for a specific period rather than for individual transactions. Underwriting and lending firms will be selected on individual transactions and will be selected based upon expertise related to the specific transaction. Additionally, the University may use the Financial Advisors, Underwriters, Lenders, and Bond Counsel selected by UNC System Office through its own similar competitive process.

- 5.3. Structure and Maturity

- Debt should be structured on a level debt basis, i.e., so that the annual debt service repayments will, as practicable, be approximately the same in each fiscal year. A deviation from these preferences is permissible if it can be demonstrated to be in the university’s best interest, such as restructuring debt to avoid a default. On projects that are designed to be self-sufficient, the debt service may be structured to match future anticipated receipts.

- The University will issue bonds to finance capital projects under the provisions of trust indentures approved by the Board of Trustees.

- Debt in the form of capitalized lease obligations will be approved by the Board of Trustees and issued on behalf of the University by the East Carolina University Real Estate Foundation, Green Town Properties Foundation, and other financing entities.

- The University will employ maturity structures that correspond with the life of the facilities financed, generally not to exceed 30 years. Equipment will be financed for a period up to 120% of its useful life. As market dynamics change, maturity structures should be reevaluated. Call features should be structured to provide the highest degree of flexibility relative to cost.

- 5.4. Variable Rate Debt

- A degree of exposure to variable interest rates within the University’s debt portfolio may be desirable to:

- 5.4.1. take advantage of repayment/restructuring flexibility; and

- 5.4.2. benefit from historically lower average interest costs; and

- 5.4.3. diversify the debt portfolio; and,

- 5.4.4. provide a hedge to short-term working capital balances.

- Management will monitor overall interest rate exposure, analyze and quantify potential risks, and coordinate appropriate fixed/variable allocation strategies.

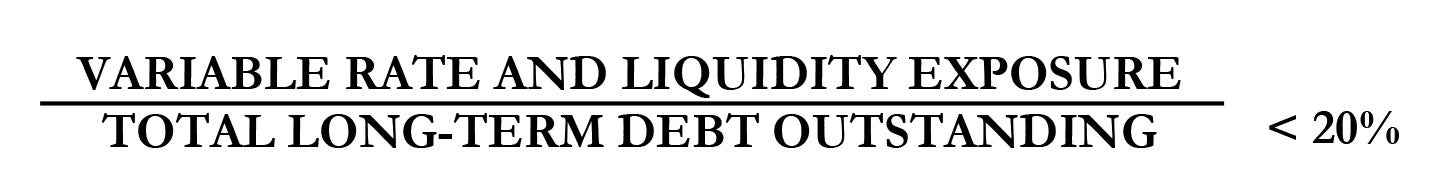

- Recognizing the desire to manage interest rate risk, the amount of variable rate debt outstanding shall not exceed 20% of the University’s outstanding debt. This limit is based on the University’s desire to:

- 5.4.5. limit annual variances in its debt portfolio,

- 5.4.6. provide sufficient structuring flexibility to management,

- 5.4.7. keep the University’s variable rate allocation within acceptable external parameters, and

- 5.4.8. use variable rate debt (and/or swaps) to optimize debt portfolio allocation and minimize costs.

- 5.5. Budgetary controls for variable rate debt:

- To avoid a situation in which debt service on variable rate bonds exceeds the annual amount budgeted; the following guidelines should be followed in establishing a variable rate debt service budget:

- 5.5.1. A principal amortization schedule should be established, with provision made for payment of amortization installments in each respective annual budget.

- 5.5.2. Provide for payment of interest for each budget year using an assumed budgetary interest rate that allows for fluctuations in interest rates on the bonds without exceeding the amount budgeted. The budgetary interest rate may be established by:

- 5.5.2.1. using an artificially high interest rate given current market conditions; or

- 5.5.2.2. setting the rate based on the last 12 months actual rates of an appropriate index plus a 200-basis point cushion or spread to anticipate interest rate fluctuations during the budget year. The spread should be determined by considering the historical volatility of short-term interest rates, the dollar effect on the budget and current economic conditions and forecasts; or

- 5.5.2.3. any other reasonable method determined by the University.

- 5.5.3. The amount of debt service incurred in each budget year should be monitored monthly by the university to detect any significant deviations from the annual budgeted debt service. Any deviations in interest rates that might lead to a budgetary problem should be addressed immediately; and

- 5.5.4. As part of the effort to monitor actual variable rate debt service in relation to the budgeted amounts and external benchmarks, the university should establish a system to monitor the performance of any service provider whose role it is to periodically reset the interest rates on the debt, i.e., the remarketing agent or auction agent.

- 5.6. Liquidity:

- One of the features typical of variable rate debt instruments is the bondholder’s right to require the issuer to repurchase the debt at various times and under certain conditions. This, in theory, could force the issuer to repurchase substantial amounts of its variable rate debt on short notice, requiring access to substantial amounts of liquid assets. Issuers that do not have substantial amounts of liquid assets may establish a liquidity facility with a financial institution that will provide the money needed to satisfy the repurchase. The liquidity provider should have a rating of A1/P1 or higher. The liquidity agreement does not typically run for the life of long-term debt. Accordingly, there is a risk that the provider will not renew the agreement or that it could be renewed only at a higher cost. Similar issues may arise if the liquidity provider encounters credit problems, or an event occurs that results in early termination of the liquidity arrangement; in either case the issuer must arrange for a replacement liquidity facility.

- 5.7. Derivatives & Swaps:

- The University recognizes that derivative products may provide for more flexible management of the debt portfolio. In certain circumstances, interest rate swaps and other derivatives permit the University to adjust its mix of fixed- and variable-rate debt and manage its interest rate exposures. Derivatives may also be an effective way to manage liquidity risks. The University will use derivatives only to manage and mitigate risk; the University will not use derivatives to create leverage or engage in speculative transactions.

- As with underlying debt, the University’s finance staff will evaluate any derivative product comprehensively, considering its potential costs, benefits, and risks, including, without limitation, any tax risk, interest rate risk, liquidity risk, credit risk, basis risk, rollover risk, termination risk, counterparty risk, and amortization risk. Before entering any derivative product, the Vice Chancellor of Administration and Finance must (1) conclude, based on the advice of a reputable swap advisor, that the terms of any swap transaction are fair and reasonable under current market conditions and (2) ensure that the University’s finance staff has a clear understanding of the proposed transaction’s costs, cash flow impact and reporting treatment.

- The University will use derivatives only when the Vice Chancellor of Administration and Finance determines, based on the foregoing analysis, that the instrument provides the most effective method for accomplishing the University’s strategic objectives without imposing inappropriate risks on the University.

- 5.8. Taxable Debt (without Federal subsidies)

- While all the University’s capital projects may not qualify for tax-exempt debt, taxable debt should be used only in appropriate cases as it represents a more expensive source of capital relative to tax-exempt issuance. Issuing taxable debt reduces the University’s overall debt affordability due to higher associated interest expense. When utilized, taxable debt will be structured to provide maximum repayment flexibility and rapid principal amortization.

- 5.9. Public Private Partnerships

- To address the University’s anticipated capital needs as efficiently and prudently as possible, the University may choose to explore and consider opportunities for alternative and non-traditional transaction structures (collectively, “P3 Arrangements”). Because rating agencies will generally treat a P3 Arrangement as University debt if the project is located on the University’s campus or if the facility is to be used for an essential University function, the structure, and terms of any P3 Arrangement for a university-related facility to be located on land owned by the State, the University or the University affiliate must be reviewed in advance by the Vice Chancellor of Administration and Finance.

- P3 Arrangements may be pursued in accordance with applicable State law when (1) the Chancellor has determined that the P3 Arrangement serves a compelling strategic interest, and (2) the Vice Chancellor of Administration and Finance, in consultation with the University’s advisors, has determined that the University has sufficient debt capacity to undertake its obligations under the P3 Arrangement after taking into account the P3 Arrangement’s likely impact on the University’s debt-related metrics and credit profile.

- 5.10. Capitalized Interest

- Capitalized interest from bond proceeds is used to pay debt service until a revenue producing project is completed or to manage cash flows for debt service in special circumstances. Because the use of capitalized interest increases the cost of the financing, it should only be used when necessary for the financial feasibility of the project. In revenue-producing transactions, the University will attempt to structure debt service payments to match the revenue structure to minimize the use of capitalized interest.

- 5.11. Credit Ratings

- The University will maintain ongoing communication and interaction with bond rating agencies, striving to educate the agencies about the general credit structure and financial performance of the University to attain the highest credit rating possible.

- 5.12. Refunding Targets

- Generally, refunding bonds are issued to achieve debt service savings by redeeming high interest rate debt with lower interest rate debt. Refunding bonds may also be issued to restructure debt or modify covenants contained in the bond documents. Current tax law prevents the issuance of tax-exempt advance refunding bonds to refinance existing tax-exempt bonds; accordingly, advance refunding bonds must be completed on a taxable basis. There is no similar limitation for tax-exempt current refunding bonds. The University will continuously monitor its outstanding tax-exempt debt portfolio for refunding and/or restructuring opportunities. The following guidelines should apply to the issuance of refunding bonds, unless circumstances warrant a deviation there from:

- 5.12.1. Refunding bonds should be structured to achieve level annual debt service savings.

- 5.12.2. The life of the refunding bonds should not exceed the remaining life of the bonds being refunded.

- 5.12.3. Advance refunding bonds issued to achieve debt service savings should have a minimum target savings level measured on a present value basis equal to 2-3% of the par amount of the bonds being advance refunded. However, because of the numerous considerations involved in the sale of advance refunding bonds, the target should not prohibit advance refunding’s when the circumstances justify a deviation from the guideline.

- 5.12.4. Refunding bonds that do not achieve debt service savings may be issued to restructure debt or provisions of bond documents if such refunding serves a compelling university interest.

- For current refunding’s, the University will consider transactions that, in general, produce present value savings (based on refunded bonds). A refunding will also be considered if it relieves the University of certain limitations, covenants, payment obligations or reserve requirements that reduce flexibility. The University will also consider refinancing certain obligations within a new money offering even if savings levels are minimal to consolidate debt into a general revenue pledge, and/or reduce the administrative burden and cost of managing many small outstanding obligations.

6. Disclosure

- 6.1. Primary Disclosure

- The University shall use best practices in preparing disclosure documents in connection with the public offer and sale of debt so that accurate and complete financial and operating information needed by the markets to assess the credit quality and risks of each debt issue is provided.

- The disclosure recommendations of the Government Finance Officers Association’s “Disclosure for State and Local Governments Securities,” and the National Federation of Municipal Analysts’ “Recommended Best Practices in Disclosure for Private Colleges and Universities” should be followed to the extent practicable, specifically including the recommendation that financial statements be prepared and presented according to generally accepted accounting principles.

- 6.2. Secondary Disclosure

- The University will continue to meet its ongoing disclosure requirements as required under Rule 15c2-12 of the Securities and Exchange Commission. The University will submit financial reports, statistical data, and any other material events as required under outstanding bond indentures.

7. Tax-Exempt Debt – Post Issuance Considerations

- 7.1. Bond Proceeds Investment

- The University will invest bond-funded construction funds, capitalized interest funds, and costs of issuance funds appropriately to achieve the highest return available under arbitrage limitations. When sizing bond transactions, the University will consider funding on either a net or gross basis.

- 7.2. Arbitrage

- The University will comply with federal arbitrage requirements on invested tax-exempt bond proceeds, causing arbitrage rebate calculations to be performed annually and rebate payments to be remitted to the IRS periodically as required.

- 7.3. Private Use and Gifts

- The University will monitor all arrangements with third parties to use bond-financed property, including the federal government and other colleges and universities, to ensure the tax-exempt status of the related debt. The University will monitor any sales of bond-financed property, and any lease management contracts, research arrangements and naming rights agreements to the extent such arrangements impact bond-financed property and will work closely with bond counsel in determining events/actions that may cause a bond issue to become taxable. The University will also work with the bond counsel to train University personnel in these matters.

- To track arrangements that could potentially result in a loss of tax-exempt status of University debt, a record of financed facilities, including facilities financed by the State will be maintained.

- The University will track gifts which are restricted to facilities financed, or to be financed with tax-exempt debt and will work with bond counsel to ensure that such gifts are used in a manner that complies with federal tax law limitations.

8. Responsibility

- 8.1. Assignment of Responsibilities

- The Vice Chancellor for Administration and Finance is responsible for overseeing capital debt management and adhering to advice and guidelines adopted by the Board of Trustees.

- 8.2. Facilities Planning and Facilities Management

- The Associate Vice Chancellor for Campus Operations will take the lead role in estimating and defining project costs and in maintaining a list of projects that are being considered. The Associate Vice Chancellor for Campus Operations will also lead the development of capital planning documents for the current year, current biennium, and the capital plan.

- 8.3. Treasury Management

- The University Controller will maintain a schedule of current and forecasted debt and associated payment of principal, interest, and fees. The Associate Vice Chancellor for Financial Services is responsible for the administration of all aspects of debt financing, including accounting, and contracting with financial advisors, underwriters, and bond counsel to issue new debt or refinance existing debt.

- 8.4. Board of Trustees

- The Board of Trustees will consider for approval each special obligation project of the University, in accordance with State law. The Board of Trustees will consider and approve this Debt Policy and any proposed changes to it.

9. Definitions

- 9.1. A-1+ Rating – Obligations rated A-1+ for short-term debt by Standard & Poor’s Ratings Service are the highest rating assigned by Standard & Poor’s.

- 9.2. Annual debt service – The principal and interest due on long-term debt in a fiscal year.

- 9.3. Bridge financing – Any type of financing used to “bridge” a period of time. For universities, it refers to financings that provide funding in advance of a long-term bond issue or the receipt of gift funding.

- 9.4. Capital project – Physical facilities or equipment or software that may be capitalized.

- 9.5. Debt to Obligated Resources Ratio – ECU’s aggregate outstanding debt as compared to its obligated Resources – the funds legally available to service its debt. Available Funds, which is the concept commonly used to capture an institution’s obligated resources in its loan and bond documentation.

- 9.6. Debt Service to Operating Expenses Ratio – ECU’s debt service burden as a percentage of its total expenses, which is used as the denominator because it is typically more stable than revenues. Annual debt service divided by annual operating expenses (as adjusted to include interest expense of proposed debt)

- 9.7. Five (5) Year Payout Ratio – The percentage of ECU’s debt scheduled to be retired in the next five years. Aggregate principal to be paid in the next five years is divided by aggregate debt.

- 9.8. GAAP – Generally Accepted Accounting Principles.

- 9.9. GASB 34 – Government Accounting Standards Board Statement that establishes financial reporting standards for state and local governments that includes Management’s discussion and analysis (MD&A) and basic financial statements.

- 9.10. GASB 35 – Government Accounting Standards Board Statement that establishes accounting and financial reporting standards for public colleges and universities within the financial reporting guidelines of GASB Statement No. 34, Basic Financial Statements and Management’s Discussion and Analysis for State and Local Governments.

- 9.11. GASB 68 – Government Accounting Standards Board Statement that requires governments providing defined benefit pensions to recognize their long-term obligation for pension benefits as a liability.

- 9.12. GASB 75 – Government Accounting Standards Board Statement intended to improve accounting and financial reporting by state and local governments for postemployment benefits other than pensions (other postemployment benefits or OPEB). It also improves information provided by state and local governmental employers about financial support for OPEB that is provided by other entities.

- 9.13. Leverage – Long-term debt as a component of the total assets of the University. “High leverage” indicates an institution that has a considerable portion of its assets that are debt financed.

- 9.14. Competitive sale – A sale of municipal securities by an issuer in which underwriters or syndicates of underwriters submit sealed bids to purchase the securities. The securities are won and purchased by the underwriter or syndicate of underwriters who submit the best bid according to guidelines in the notice of sale.

- 9.15. Negotiated sale – In a negotiated underwriting, the sale of bonds is by negotiation and agreement with an underwriter or underwriting syndicate selected by the issuer before the moment of sale. This contrasts with a competitive or an advertised sale.

- 9.16. Advance refunding – A financing structure under which new bonds are issued to repay an outstanding bond issue more than ninety (90) days from the date of issuance of the new issue. Generally, the proceeds of the new issue are invested in government securities, which are placed in escrow. The interest and principal repayments on these securities are then used to repay the old issue, usually on the first call date. Advance refundings are done to save interest, extend the maturity of the debt, or change existing restrictive covenants.

- 9.17. Current refunding – Sale of a new issue, the proceeds of which are to be used, within ninety (90) days, to retire an outstanding issue by, essentially, replacing the outstanding issues with the new issue. Current refundings are done to save interest cost, extend the maturity of the debt, or change existing restrictive covenants.

- 9.18. Primary disclosure – SEC Rule 15c2-12 obligates underwriters participating in primary (new) offerings of municipal securities (of $1,000,000 or more; are sold to more than 35 people; and have a maturity greater than 9 months) to obtain, review, and distribute to investors copies of the issuer’s official statement. While previously exempt, as of December 1, 2010, all new Variable Rate Demand Obligations will also be subject to Rule 15c2-12.

- 9.19. P-1 Rating – Obligations rated P-1 for short-term debt by Moody’s Investors Service, Inc. are defines as having the highest quality, subject to the lowest level of risk.

- 9.20. Secondary disclosure – At the time bonds are offered, the issuer must outline the type of Annual Financial Information it will provide annually and the terms of its continuing disclosure agreement. Also, Rule 15c2-12 requires dealers acting as underwriters in offerings to reasonably determine that the issuer or obligated person has undertaken in a continuing disclosure agreement to provide event notices to the MSRB, in an electronic format and in a timely manner of not more than ten business days, when any of the following events with respect to the securities being offered occurs:

- 9.20.1. Principal and interest payment delinquencies with respect to the securities being offered.

- 9.20.2. Non-payment related defaults, if material.

- 9.20.3. Unscheduled draws on debt service reserves reflecting financial difficulties.

- 9.20.4. Unscheduled draws on credit enhancements reflecting financial difficulties.

- 9.20.5. Substitution of credit or liquidity providers, or their failure to perform.

- 9.20.6. Adverse tax opinions, Internal Revenue Service issuance of proposed or final determinations of taxability, notices of proposed issue, or other material notices or determinations with respect to the tax status of the security, or other material events affecting the status of the security.

- 9.20.7. Material modifications to rights of security holders.

- 9.20.8. Material bond calls, and tender offers.

- 9.20.9. Defeasances.

- 9.20.10. Release, substitution, or sale of property securing repayment of the securities, if material.

- 9.20.11. Rating changes.

- 9.20.12. Bankruptcy, insolvency, receivership, or similar event of the obligated person.

- 9.20.13. Consummation of a merger, consolidation, or acquisition; acquisition involving an obligated person or the sale of all or substantially all of the assets of the obligated person, other than in the ordinary course of business; the entry into a definitive agreement to undertake such an action; or the termination of a definitive agreement relating to any such actions, other than pursuant to is terms, if material.

- 9.20.14. Appointment of a successor or additional trustee or the change of name of a trustee if material.

- 9.20.15. Incurrence of a financial obligation of the obligated person, if material, or agreement to covenants, events of default, remedies, priority rights, or other similar terms of a financial obligation of the obligated person, any of which affect security holders, if material.

- 9.20.16. Default, event of acceleration, termination event, modification of terms, or other similar events under the terms of a financial obligation of the obligated person, any of which reflect financial difficulties.